In this article, I will answer question number four in regards to financial preparation for the entrepreneurial journey. I will explain how I prepared and how our family is dealing with the Coronavirus situation.

The structure of the article:- Optimizing your home budget

- Establish short term and long term monetary goals

- Exchange tips with other Entrepreneurs

- Preparation during the Coronavirus pandemic

1- Optimizing your home budget

How am I going to support myself or my family if there's no income during the first few months of the venture?

The question above is perhaps the most fear-inducing and what prevents most people from taking the entrepreneurial jump. But if you make a plan and prepare, you can convert that fear into confidence.

Having a budget is the easiest way to plan and to see how much money you are going to need to support your family. Once you know your base number, you can look at elements within to see if there are areas to optimize.

Our family thrives when we spend time together, so optimizing our eating out budget also optimized our quality time by cooking dinner together. We now eat better by cooking with whole ingredients, and we can involve our son in the process. This optimization alone has reduced our monthly grocery bill by 40%

There are many areas to optimize your home budget before you start the venture, but it often means you have to do things yourself. In my home, Landscape maintenance, carwash, and cooking bring an average savings of $500 per month! Since we have to perform these "home jobs," having a daily and weekly schedule is imperative to leave enough time for your entrepreneurial work.

When was the last time you got quotes on services and insurance? This day and age, loyalty is punished rather than rewarded. The bills for cable, cell phone, streaming services, etc. can be reduced and help you lower your monthly expenses without sacrificing the quality of life.

Now that you have this extra cash, you can increase your savings to create a cushion during an emergency and while your venture takes off.

Once you optimize everything you can, it is time to fix the other side of the equation, the income.

In my path to entrepreneurship, the only way to exponentially increase my income was to put all my efforts into Branding Phoenix.

One vital tool to help in the journey is to see how other entrepreneurs are doing on this path—more on this on my next point.

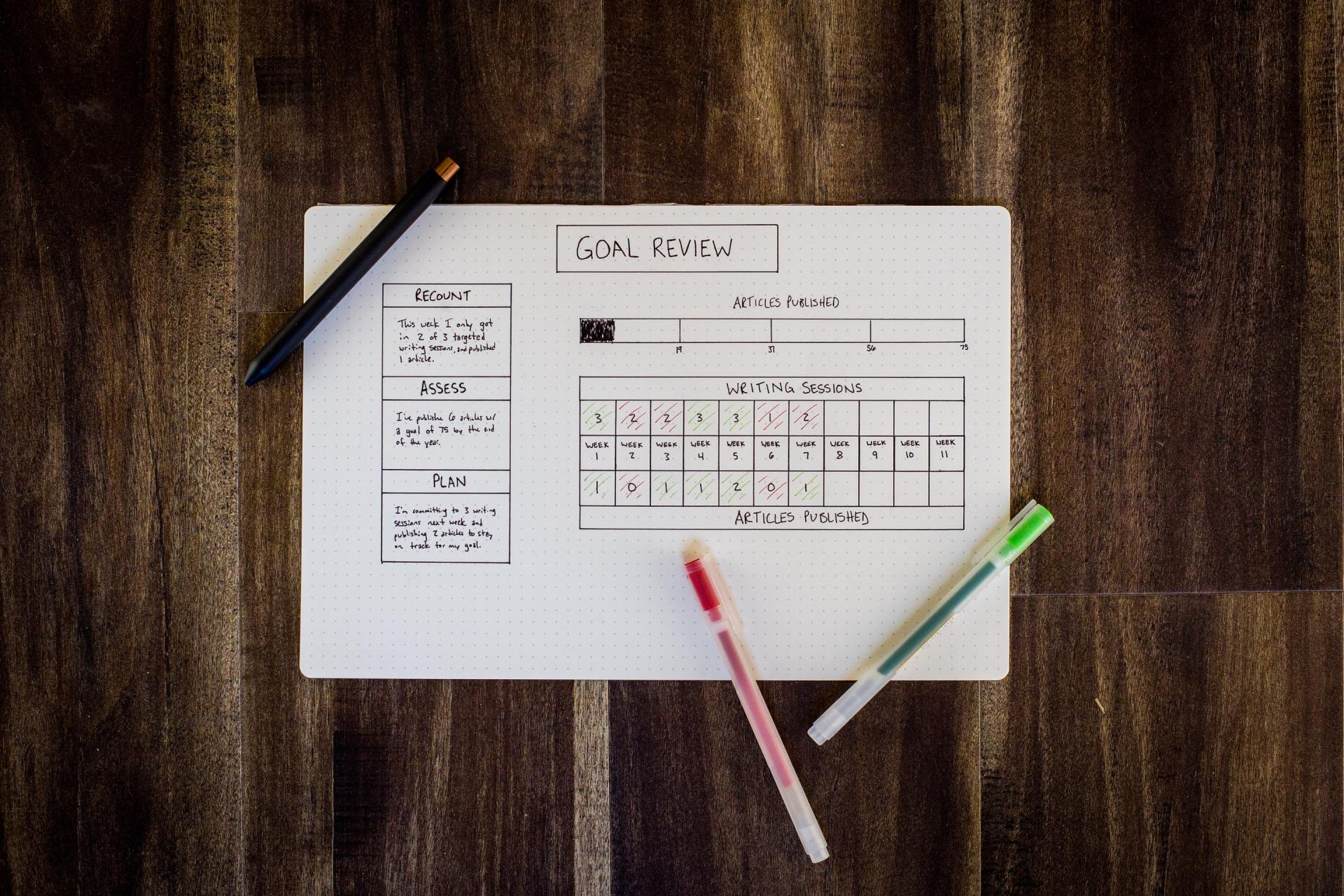

2- Establish short term and long term monetary goals

One of the driving goals and force that has influenced my thinking and encouraged my journey has been the "FIRE" Community (Financial Independence Retire Early). The message in its most simplistic form is to save 50% of your income for ten years, and you will be financially independent. Being financially independent gives you the freedom and peace to jump and soar into the entrepreneurial journey.

My must listen to podcasts in the financial and optimization realm include

ChooseFI

and

Clark Howard. These shows answer and showcase stories of families and individuals who are pursuing financial independence.

Having the encouragement of these stories helped me formulate a plan that I could share with my wife so that together we can make the jump into entrepreneurship.

My plan is going to be different than yours based on your monthly monetary needs. Because we optimized our monthly budget, our savings can sustain the journey for six months or more.

My short term goal is to replace my last job's monthly income within three months. I started on February 11th, putting all efforts into Branding Phoenix. I will report back in May on my progress. The Convid-19 situation will undoubtedly be a challenge. Still, because our family planned and optimized way before this became a real problem, we were already mentally and monetarily prepared for a shortage of income.

The beauty of a business plan is that it gives you focus. You can expand or contract the plan depending on your needs, wants, and values.

I have a six, twelve, and twenty-four-month goal. These goals are closely linked to our home budget needs now and in two years. In two years, our needs will be significantly less so that we can save more money and get closer to that 50% savings rate between my wife's income and mine.

3- Watch the monthly business expenses

Starting a business can be overwhelming if you haven't prepared for all the "hats" you have to wear when you begin. Most entrepreneurs begin as "solopreneurs." As a one-person team, you need to have experience in the following:

- Sales

- Management

- Accounting

- Marketing

There are many other "hats" you can wear within these four areas, and if you are not good at any of them, you need to prepare before you go on your own.

The more you have experience in these fields, the lower your business expenses will be at the beginning, and more of your capital can be spent on growing the business. The plan with any company is to grow to a point where you can remove these hats and keep the hats you like.

If you don't like to be in front of people or manage people, you need to find people that will represent your business and manage your employees. If you don't like numbers, you need to find someone to help you as well. If you need this help very early in the business journey, you need to know that your expenses will be high, and the need to bring in more sales will be more significant to compensate for the costs.

I believe one of the reasons most businesses fail is because we start spending money too soon on services. Once we hit the submit button to register your business, you will be targeted. You will be followed everywhere you go on the internet. The phone will ring. People will knock at your door—all to sell you the services needed for a business.

One of my missions with this blog is to demystify and help you navigate all of this. I want to see more of my fellow entrepreneurs succeed on the journey rather than being bogged down with expenses too early on.

Some of the services we get sold are great and will help us grow, but if you jump too soon, they will drag you down. Some services and tools will let you start for free and charge you as you grow. I will list some of them on a future post.

4- Exchange tips with other entrepreneurs

You are not an island. You need to develop friendships with other entrepreneurs and the "competition." I recommend that you join guilds in your industry. You will learn and grow. There's business for everyone. Competition is what makes us better at our craft and keeps us learning new things. You will also learn from mistakes others have made so that you don't have to experience them. You can also share your experiences to help others.

5- Preparation during the Coronavirus pandemic

One of my plans, before I took the jump, was to schedule my time on social media and the news. These two information avenues are pits that will DEMAND your attention and take you away from important work and time with family. Notice that I said "Schedule" and not eliminate. I also decided to go to the sources of truth, not the emotionally charged opinions.

Here are some thoughts to consider:

- There's always a silver lining with every crisis, and here are some things to consider while you are "Stuck" at home working or spending time with family.

- If you are working from home, do your best work so that you can show your employer that you can be more productive and possibly negotiate work from home hours. Imagine all the extra time you could gain if you didn't have to spend time in traffic, commuting, and chit-chatting with coworkers.

- With the extra time, you can explore a "side hustle" that can turn into your new business venture.

- If you have a family, they likely want your attention, so schedule time with them and teach them some of what you do. We do all the work to support them anyway. They will appreciate you more.

- A downed stock market creates an opportunity for investing and buying stocks on sale. I recommend the book "The Simple Path to Wealth."

This book will help you understand that the market always goes up over the long term and that you should invest solely in the lowest cost, broad-based funds available to mitigate risk and maximize returns. Again, LONG TERM. Buying and selling short term is gambling, and not even the "gurus" can predict.

- If you are a business owner, this is the time to write a blog for your business to increase exposure. Social media posts are here today and gone tomorrow (unless you pay), but your business story in a blog is searchable and can work for you day and night.

Be encouraged. Watch and pray. This situation shall pass. Life conditions like this pandemic are opportunities to help us reflect and prioritize.

If you are interested to read other articles in this series, here are the direct links: